irs child tax credit 2021

Child Tax CreditCredit for Other Dependents CTCODC Provides a tax benefit for families with a qualifying dependent child and families with dependents who dont qualify for the CTC. Use our child tax credit calculator to determine your eligibility for tax year 2020 or tax year 2021.

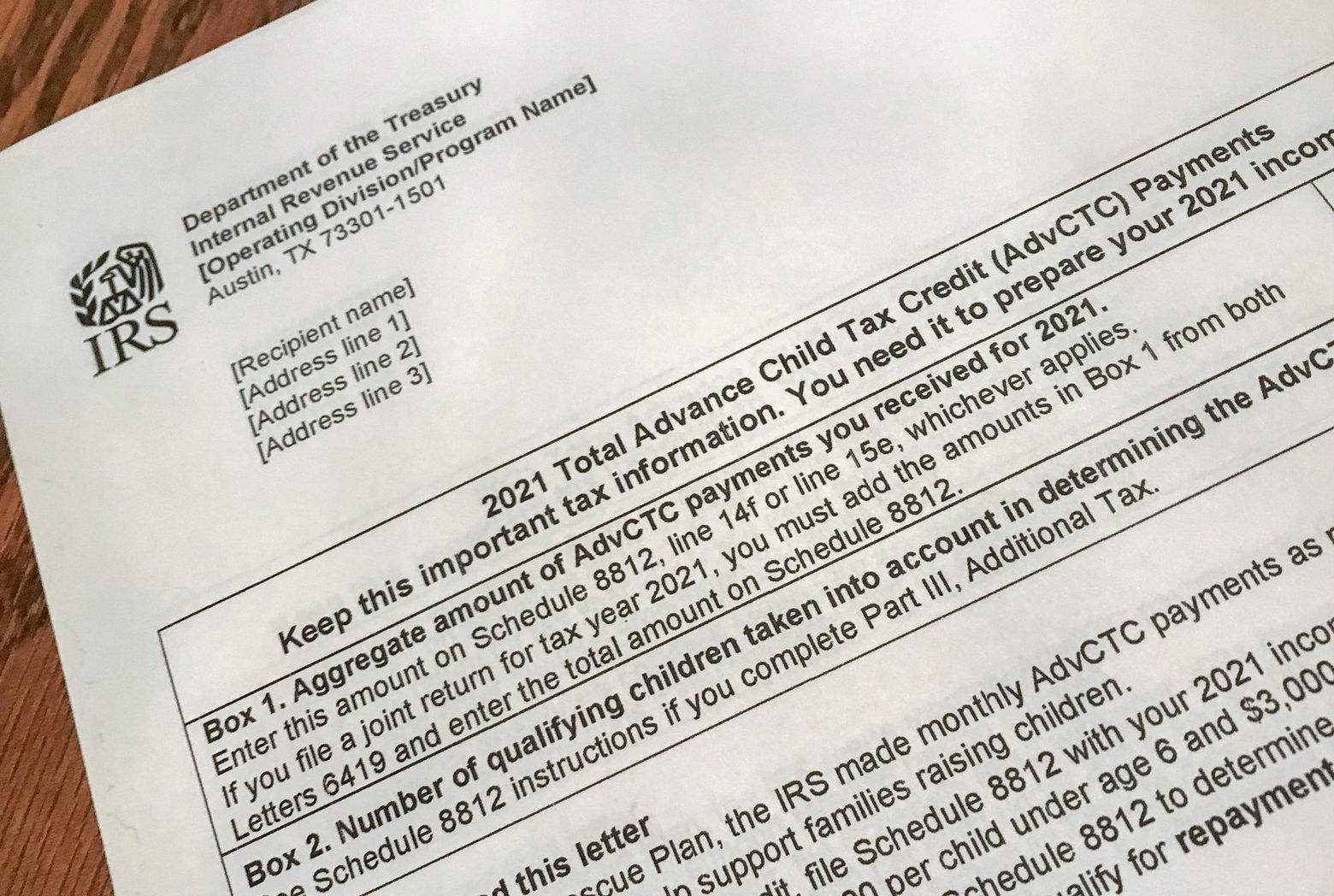

Advance Child Tax Credit CTC A word of caution to all married parents filing a joint return for tax year 2021 who received advance Child Tax Credit CTC payments in 2021.

. Earned Income Tax Credit EITC - Helps low- to moderate-income workers and families get a tax break. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. You must combine the total amounts shown in box 1 of both IRS Letters 6419 when you file your federal income tax return this year.

Excess Advance Child Tax Credit Payment Amount. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or. If you claimed married filing joint status on the tax return.

Who is Eligible. Length of residency and 7. Prepare accurate tax returns for people who claim certain tax credits such as the.

Enter Payment Info Here tool or. The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and 17.

If you received a total amount of advance Child Tax Credit payments that exceeds the amount of Child Tax Credit that you can properly claim on your 2021 tax year you may need to. You andor your child must pass all seven to claim this tax credit. Entered your information in 2020 to get stimulus Economic Impact payments with the Non-Filers.

Irs Recovery Rebate Tax Credit 2022 How To Claim It Next Year Marca

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

Here Is How The Federal Interest Price Can Help Save The Economic Climate During A Recession Tax Refund Interest Rates Check And Balance

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Irs Notice Cp11 Notice Of Miscalculation Irs Irs Taxes Tax

Important Child Tax Credit Form Coming For Families In The Mail Kare11 Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Warns Of Child Tax Credit Scams Abc News

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Child Tax Credit What To Do If You Didn T Receive A Letter 6419 Marca

Child Tax Credit Delayed How To Track Your November Payment Marca

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Wtform Child Tax Credit Letter 6419 Explained Youtube

Tax Season 2022 Tips For A Speedy Refund And How To Avoid Gumming Up The Works The Seattle Times

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Summer Camp Tax Credit Infographic Https Www Idtech Com Blog Is Summer Camp Tax Deductible Infographic Id Tech Summer Camp Infographic

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com